does maine tax retirement pensions

For new teachers starting out in Maine they can retire with their full benefits when they reach 65 years of age and have at least 1 year of service. June 6 2019 239 am.

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

June 6 2019 239 AM Maine allows for a deduction of up to 10000 per year on pension income.

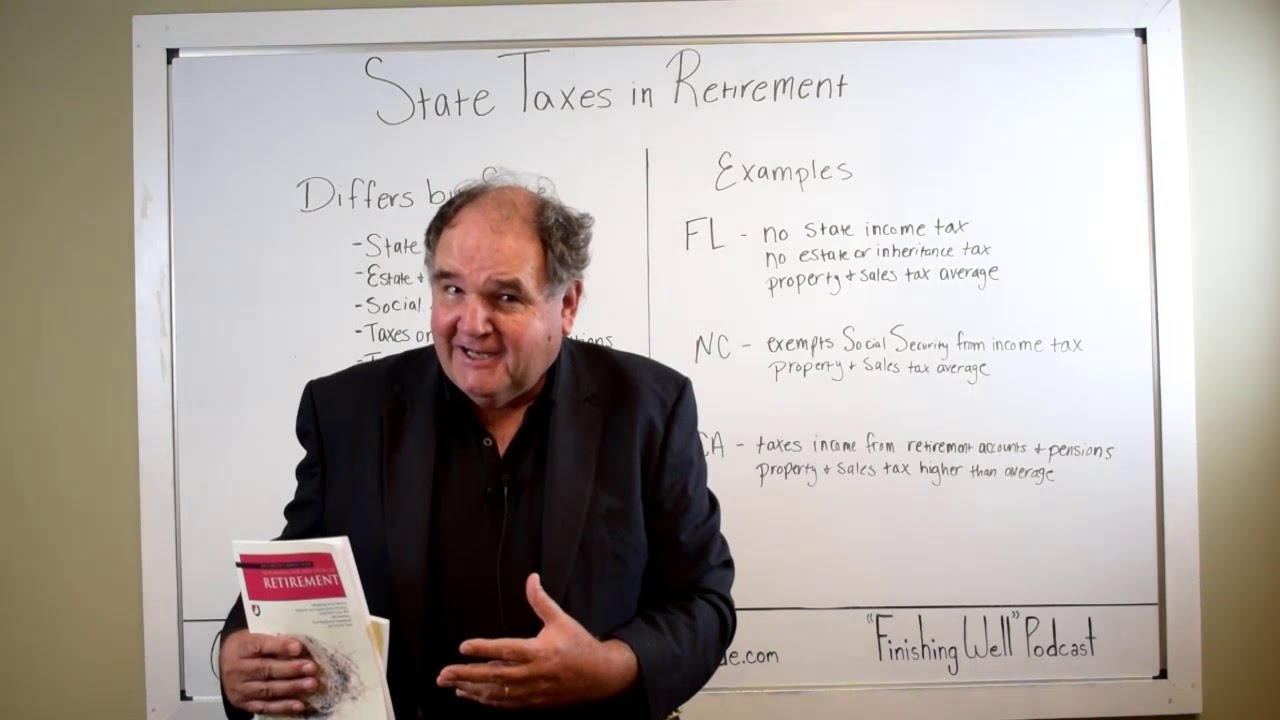

. Maine Revenue Services processes the Income Tax Withholding Quarterly Return Form 941ME as well as the Unemployment Contributions Report Form ME UC-1. States That Dont Tax Retirement Income Eight states have no state income tax. June 6 2019 239 am.

First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. In addition several states provide tax exemptions or exclusions for which Mass. The other state has no income tax You may not deduct income you received from a contributory annuity pension endowment or retirement fund of another state or its political.

The 10000 must be. Employer Self Service login. 52 rows The following taxability information was obtained from each states web site.

We also strongly recommend that you do some further preparation such as discussing. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. They are listed in the chart below.

Additionally Maine allows early. When evaluating retirement destinations avoiding the states that do tax federal government pensions could save a federal retiree thousands of dollars in state taxes every. So you can deduct that amount when calculating what you owe in.

Does Maine Tax Retirement Pensions. Benefit Payment and Tax Information In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who. Military retirement pay is exempt from taxes beginning Jan.

Retiree paid Federal taxes on contributions made before January 1 1989. However that deduction is reduced in an amount equal to your annual Social. Is my retirement income taxable to Maine.

What states do not tax pensions. One of the biggest factors that will determine your tax bill in retirement is where you live and. Call us toll free.

Retiree already paid Maine state taxes on all of their contributions. Those eight Alaska Florida Nevada South Dakota. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

For example Maine offers a. Military retirees are allowed to deduct up to 6250 of their pension through the end of tax year 2021. Retiree has not paid Federal or State taxes on the.

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

Windfall Provision Iis Financial Services Financial Advisor In Augusta Maine

File Your 2022 Maine State Income Tax Return Now

Benefit Payment And Tax Information Mainepers

Which States Are Best For Retirement Financial Samurai

15 States That Don T Tax Retirement Income Pensions Social Security

Learn About Retirement Income And Annuity Tax H R Block

The Most Tax Friendly States For Retirees Vision Retirement

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

Mar News Maine Association Of Retirees Farmingdale

States That Don T Tax Military Retirement Pay Discover Here

Retiring These States Won T Tax Your Distributions

Tax Friendly States That Don T Tax Pensions Or Social Security Sofi

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

Best Worst States To Retire In 2022 Guide

Pension Tax By State Retired Public Employees Association

How Every State Taxes Differently In Retirement Cardinal Guide