san francisco gross receipts tax instructions 2020

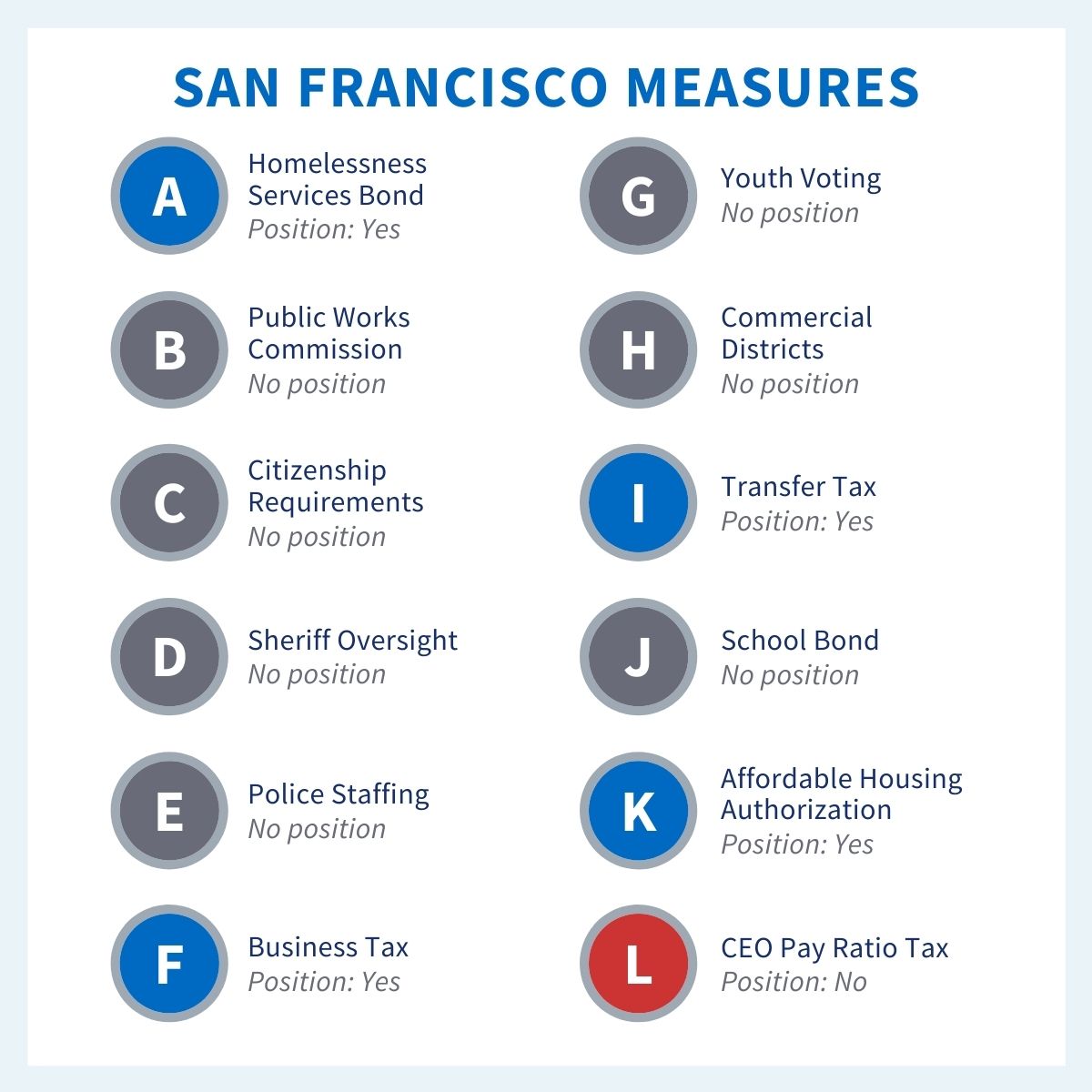

San Francisco Proposition L was on the ballot as a referral in San Francisco on November 3 2020. You must pay the 2021-2022 business registration fee by November 1 2021 and our office is missing critical information about your 2020 gross receipts to create your bill.

3 11 16 Corporate Income Tax Returns Internal Revenue Service

The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014.

. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns. It includes the political theories and movements associated with. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns.

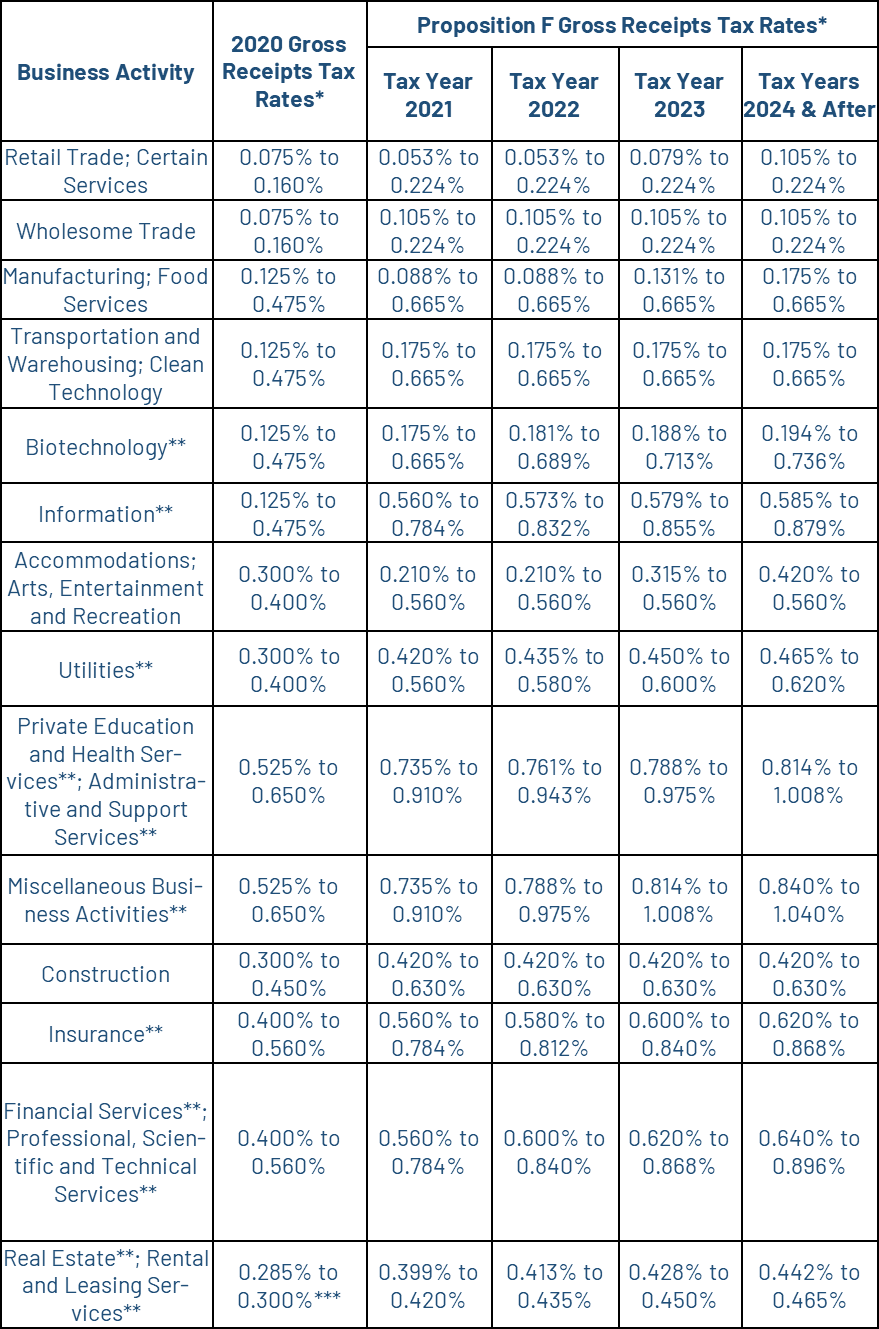

F The amount of gross receipts from certain services activities subject to the gross receipts tax shall be the total amount determined under Section 9562. Annual business registration fees. In November of 2020 San Francisco voted to increase Gross Receipt Tax rates in a shift to do away with the payroll tax and slowly increase GRT by 40 in all industries up to.

City and County of San Francisco 2000-2020. Payroll Expense Tax. For the gross receipts tax gr we calculate 25 of your gross receipts tax liability for 2021.

Annual Business Tax Return Instructions 2020 The San Francisco Annual. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. It was approved.

Buying a Car Tax-Deductible. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. Annual Business Tax Returns 2020 Treasurer Tax.

On September 9 2020. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. The City of San Francisco passed The Gross Receipts Tax and. Under the general rule the registration fee is 90 for businesses with less than 100000 in receipts which increases to 35000 for businesses with more than.

To begin filing your 2020 Annual. A yes vote supported authorizing an additional tax of. San Francisco businesses are also subject to annual registration fees based on San Francisco gross receipts for the immediately preceding tax year.

All Persons Interested in re. Gross Receipts Tax Applicable to Private Education and Health Services. 1 Taxpayers can request a 60-day extension if they file the request in.

And Miscellaneous Business Activities. Administrative and Support Services. You can learn more about san franciscos gross receipts tax here.

San Franciscos 2019 gross receipts tax and payroll expense tax are due on or before March 2 2020. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Added by Proposition E App.

On September 9 2020 the California Supreme Court declined to review the California Court of Appeals decision in City and Cnty. Of San Francisco v. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Your 8 Most Vexing Tax Questions Answered The New York Times

November 2020 Voter Guide San Francisco Techequity Collaborative

Blog San Francisco Berniecrats

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

New York Introduces Bill For A 5 Gross Receipts Tax Marcum Llp Accountants And Advisors

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Business Tax Renewal Instructions Los Angeles Office Of Finance

State Corporate Income Tax Rates And Brackets For 2019

State Gross Receipts Tax Rates 2021 Tax Foundation

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

3 21 3 Individual Income Tax Returns Internal Revenue Service

Doordash 1099 Taxes And Write Offs Stride Blog

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

San Francisco Gross Receipts Tax

Demystifying The Form 5471 Part 12 Schedule H Calculating The E P Of A Controlled Foreign Corporation Sf Tax Counsel

The Complete Guide To Filing Your Shopify 1099 Taxes In 2022